Stablecoins: Difference between revisions

Calebeaton (talk | contribs) No edit summary |

Calebeaton (talk | contribs) No edit summary |

||

| (10 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

The fundamental problem with stablecoins is that they are tied to the USD, a fiat currency known to be losing its value at roughly 10% per year. Other problems include the fact that you can't self-custody, i.e. the keys can't be buried in your backyard. | The fundamental problem with stablecoins is that they are tied to the USD, a fiat currency known to be losing its value at roughly 10% per year. Other problems include the fact that you can't self-custody, i.e. the keys can't be buried in your backyard. | ||

Nevertheless, for most of the world, stablecoins (specifically Tether) are a godsend because the fiat currency of their countries are so much worse than USD. Everybody outside the US wants USD | Nevertheless, for most of the world, stablecoins (specifically Tether) are a godsend because the fiat currency of their countries are so much worse than USD. Everybody outside the US wants USD. | ||

'''Gresham's Law: "Bad money drives out good." In other words, when there are two forms of currency in circulation, one that is of lesser intrinsic value (bad money) will be used in transactions, while the more valuable currency (good money) will be hoarded or exported.''' | |||

It is also useful to note that Tether is being embraced by the US Government because it has become [https://x.com/ericleifols/status/1890928577517871599 one of the largest buyers and holders of US Treasuries]. As other nations start rejecting US debt, Tether has started to serve as the vehicle to vacuum it up. | |||

Tether will help prolong USD's survival and dominance around the world. US politicians are embracing it. | |||

</br> | |||

</br> | </br> | ||

Announcement by US Treasury Secretary Scott Bessent at the US Digital Assets Summit, March 7, 2025: | |||

"we are going to keep the US the dominate reserve currency in the world and we will use stablecoins to do that."</br> | |||

(7-second video)</br> | |||

<html> | |||

<blockquote class="twitter-tweet" data-media-max-width="560"><p lang="en" dir="ltr">This was hands down the most important thing said at the digital asset summit. <br><br>If you don't believe me or don't get it, I don't have time to try to convince you, sorry. <a href="https://t.co/93q2CClq3b">pic.twitter.com/93q2CClq3b</a></p>— Magoo PhD (@HodlMagoo) <a href="https://twitter.com/HodlMagoo/status/1898472184772780411?ref_src=twsrc%5Etfw">March 8, 2025</a></blockquote> <script async src="https://platform.twitter.com/widgets.js" charset="utf-8"></script> | |||

</html></br> | |||

* [https://x.com/JonnieKing/status/1898141461469970577 More detailed post and video on results of the US Digital Assets Summit] | |||

----- | |||

</br> | </br> | ||

Adam Curry nicely breaks down how Stablecoins work, Tether, and the likely future of the US Digital Dollar system in this 5-minute segment from the Joe Rogan show.</br> | Adam Curry nicely breaks down how Stablecoins work, Tether, and the likely future of the US Digital Dollar system in this 5-minute segment from the Joe Rogan show.</br> | ||

<html> | <html> | ||

| Line 12: | Line 29: | ||

</br> | </br> | ||

</br> | </br> | ||

25-minute segment of a roundtable discussion in which Bitcoiners think through the impact of Tether on 140 different fiat currencies and the circuitous journey which will ultimately lead to Bitcoin.</br> | 25-minute segment of a roundtable discussion in which Bitcoiners think through the impact of Tether on 140 different fiat currencies and the circuitous journey which will ultimately lead to Bitcoin.</br> | ||

<html> | <html> | ||

| Line 19: | Line 37: | ||

</br> | </br> | ||

January 30, 2025 - Interesting new wrinkle in the Tether/Bitcoin relationship: Tether announced that it will mint Tether directly on Bitcoin's Lightning network. | January 30, 2025 - Interesting new wrinkle in the Tether/Bitcoin relationship: Tether announced that it will mint Tether directly on Bitcoin's Lightning network. Analysis is still coming ([https://x.com/sebbunney/status/1890408657139167650 see this X post]), but this move seems to make Tether more efficient, trustworthy, and universal. (1-minute announcement video) | ||

<html> | <html> | ||

</br> | </br> | ||

| Line 27: | Line 45: | ||

</br> | </br> | ||

An even bigger perspective is that this is yet another proof that the entire financial world is being reprogrammed to operate on top of Bitcoin rails. Bitcoin ownership is a simple way to get hugely diversified exposure to the productivity of the new decentralized world. Simply having bitcoin "under the mattress" will allow one's value to rise as the new Googles, Facebooks, Visas, Wells Fargos, etc. are built on top of bitcoin to take advantage of its efficiencies and trustlessness—no middlemen needed for finality of transactions. | |||

---- | |||

'''Tether CEO: ''"I expect a financial reset, where all national currencies will collapse and experience hyperinflation. Consequently, USDT will be completely useless, and at that point, I believe the world will only use Bitcoin."''''' [https://news.bitcoin.com/tether-ceo-paolo-ardoino-usdt-will-be-useless-in-the-long-term/ Feb 27, 2025 Interview] | |||

---- | |||

The bottom line is that Tether will be a huge simplification of the USD system by removing banks, weekends, personnel, banking holidays, credit cards, payment gateways, and dozens of other unnecessary middlemen from transactions. Tether will also benefit the world by removing the inefficiencies and complexities of 140 different fiat currencies. But even longer term, people should be aware that Tether/USD continues to be a melting ice cube as its value is tied directly to the USD, a fiat currency. For anything other then day-to-day transactions, people should consider moving value into the harder, non-country-specific, equally convenient protocol/currency/commodity of Bitcoin. | |||

</br> | |||

</br> | |||

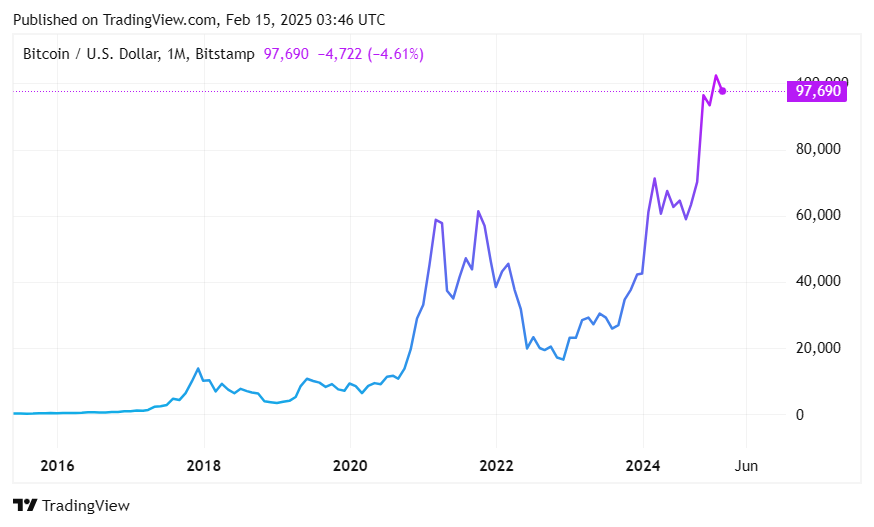

One need only to look at a Bitcoin-to-USD chart to get a feel for the horrific long-term performance to expect from Tether. | One need only to look at a Bitcoin-to-USD chart to get a feel for the horrific long-term performance to expect from Tether. | ||

[[File:BTCUSD. | [[File:BTCUSD.png|Bitcoin priced in USD from 2016]] | ||

{{Template:Bitcoin-Nav}} | {{Template:Bitcoin-Nav}} | ||

Latest revision as of 16:42, 9 March 2025

The fundamental problem with stablecoins is that they are tied to the USD, a fiat currency known to be losing its value at roughly 10% per year. Other problems include the fact that you can't self-custody, i.e. the keys can't be buried in your backyard.

Nevertheless, for most of the world, stablecoins (specifically Tether) are a godsend because the fiat currency of their countries are so much worse than USD. Everybody outside the US wants USD.

Gresham's Law: "Bad money drives out good." In other words, when there are two forms of currency in circulation, one that is of lesser intrinsic value (bad money) will be used in transactions, while the more valuable currency (good money) will be hoarded or exported.

It is also useful to note that Tether is being embraced by the US Government because it has become one of the largest buyers and holders of US Treasuries. As other nations start rejecting US debt, Tether has started to serve as the vehicle to vacuum it up.

Tether will help prolong USD's survival and dominance around the world. US politicians are embracing it.

Announcement by US Treasury Secretary Scott Bessent at the US Digital Assets Summit, March 7, 2025:

"we are going to keep the US the dominate reserve currency in the world and we will use stablecoins to do that."

(7-second video)

This was hands down the most important thing said at the digital asset summit.

If you don't believe me or don't get it, I don't have time to try to convince you, sorry. pic.twitter.com/93q2CClq3b— Magoo PhD (@HodlMagoo) March 8, 2025

Adam Curry nicely breaks down how Stablecoins work, Tether, and the likely future of the US Digital Dollar system in this 5-minute segment from the Joe Rogan show.

🚨NEW: Adam Curry nicely breaks down how Stablecoins work, Tether, and the likely future of the US Digital Dollar system. (Worth a watch if you don't know about this subject)

"A stablecoin is a digital dollar thats pegged to the dollar so it's always a dollar. It's already being… pic.twitter.com/tpllY9kuGr— Autism Capital 🧩 (@AutismCapital) February 14, 2025

25-minute segment of a roundtable discussion in which Bitcoiners think through the impact of Tether on 140 different fiat currencies and the circuitous journey which will ultimately lead to Bitcoin.

January 30, 2025 - Interesting new wrinkle in the Tether/Bitcoin relationship: Tether announced that it will mint Tether directly on Bitcoin's Lightning network. Analysis is still coming (see this X post), but this move seems to make Tether more efficient, trustworthy, and universal. (1-minute announcement video)

Tether 🧡 Bitcoin

Tether Brings USDt to Bitcoin’s Lightning Network, Ushering in a New Era of Unstoppable Technology

Read more: https://t.co/xJVKLHfht0 pic.twitter.com/PfftiXMLSO— Tether (@Tether_to) January 30, 2025

An even bigger perspective is that this is yet another proof that the entire financial world is being reprogrammed to operate on top of Bitcoin rails. Bitcoin ownership is a simple way to get hugely diversified exposure to the productivity of the new decentralized world. Simply having bitcoin "under the mattress" will allow one's value to rise as the new Googles, Facebooks, Visas, Wells Fargos, etc. are built on top of bitcoin to take advantage of its efficiencies and trustlessness—no middlemen needed for finality of transactions.

Tether CEO: "I expect a financial reset, where all national currencies will collapse and experience hyperinflation. Consequently, USDT will be completely useless, and at that point, I believe the world will only use Bitcoin." Feb 27, 2025 Interview

The bottom line is that Tether will be a huge simplification of the USD system by removing banks, weekends, personnel, banking holidays, credit cards, payment gateways, and dozens of other unnecessary middlemen from transactions. Tether will also benefit the world by removing the inefficiencies and complexities of 140 different fiat currencies. But even longer term, people should be aware that Tether/USD continues to be a melting ice cube as its value is tied directly to the USD, a fiat currency. For anything other then day-to-day transactions, people should consider moving value into the harder, non-country-specific, equally convenient protocol/currency/commodity of Bitcoin.

One need only to look at a Bitcoin-to-USD chart to get a feel for the horrific long-term performance to expect from Tether.

. . .

Return to Bitcoin home page